Qualified Widower Filing Status 2025. Your spouse/rdp died in 2025 or 2025 and you did not remarry or enter into another registered domestic partnership in 2025. Each year, you should choose the filing status that accurately matches your circumstances.

Who Is a Qualifying Widower or Widow? Tax Filing Status Explained, Introduction to qualified widow or widower status. Page last reviewed or updated:

Filing Status Line 5 the Filing Status of Qualifying Widower Fill Out, Each year, you should choose the filing status that accurately matches your circumstances. Starting in tax year 2025 the qualified.

:max_bytes(150000):strip_icc()/qualified-widow-or-widower.aspfinal-e4edf21eb1b04d0ba49016fbd0c8cf57.jpg)

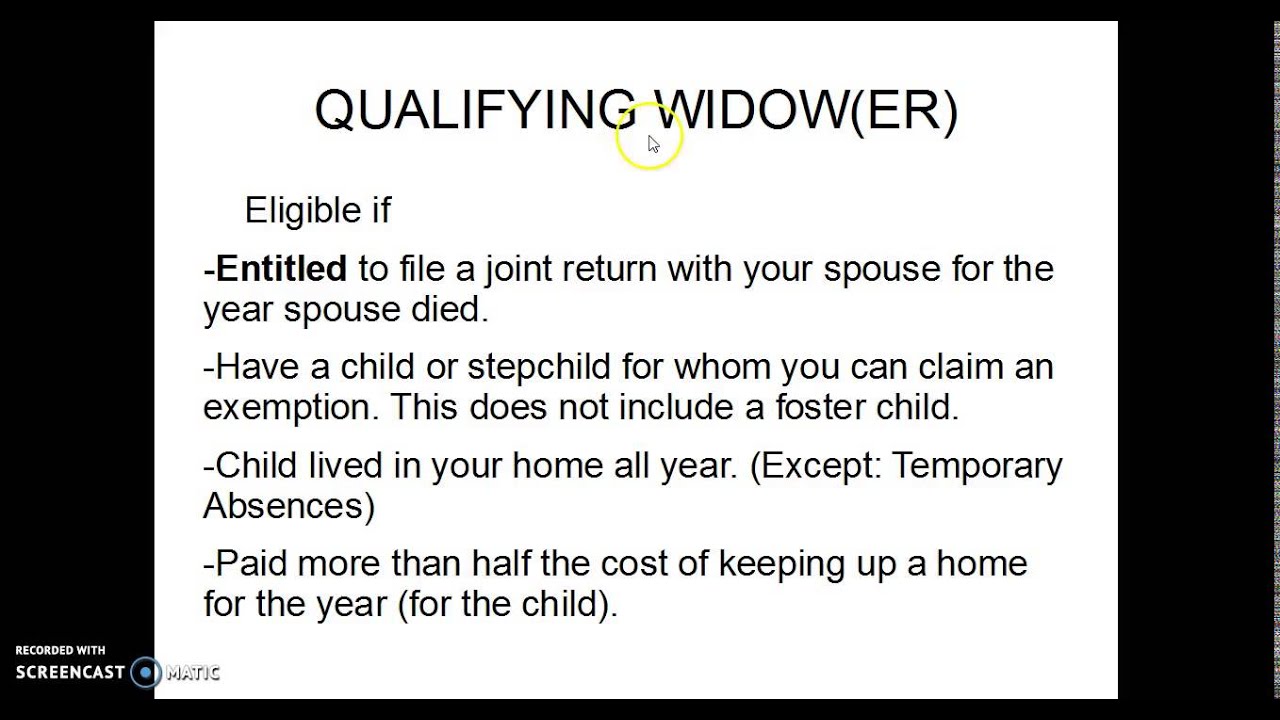

Qualifying Widow(er) Filing Status YouTube, • december 20, 2018 • 6 min read. If you’re married, or a qualified widower s ,.

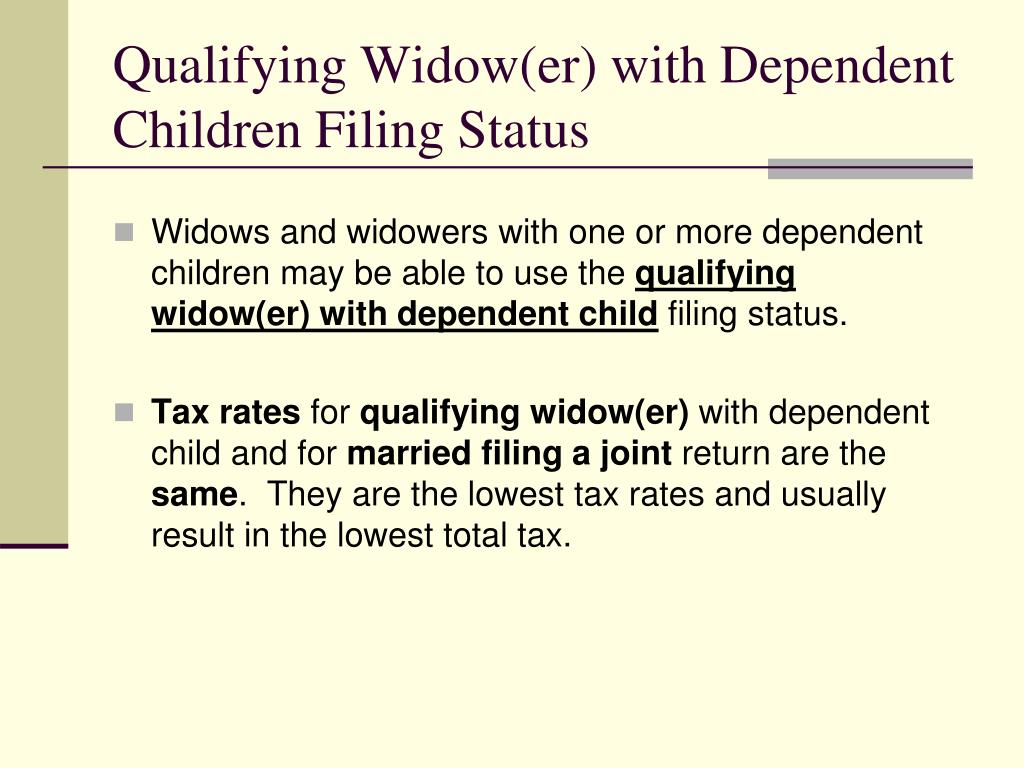

Qualifying Widow(er) Filing Status Explained, A qualified widow or widower is a tax filing status in the united states that allows a surviving spouse to maintain the same tax benefits as a married couple filing jointly, but. Introduction to qualified widow or widower status.

qualified widower filing statusCPA regulation YouTube, For two years after the year of your spouse’s death you can use the qualifying widower status if all of these are true: You qualify if all of the following apply:

PPT Tax Unit Module 5 PowerPoint Presentation, free download ID, The 2025 tax rates for married filing separately are as follows: You qualify if all of the following apply:

What Tax Breaks Are Afforded to a Qualifying Widow?, Choosing your correct tax filing status will determine your federal tax bracket and the amount of tax you pay, as well as your standard deduction. Page last reviewed or updated:

What is Qualifying Widow er Tax Filing YouTube, Introduction to qualified widow or widower status. The rules for using this filing status are explained in.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

Fillable Online Qualifying Widow, Widower Tax Filing Status Fax Email, A qualified widow or widower, for tax purposes, is a. Eligibility criteria for filing as a qualifying.

Fillable Online Qualifying Widower, Widow Tax Return Filing Status, Choosing your correct tax filing status will determine your federal tax bracket and the amount of tax you pay, as well as your standard deduction. Qualifying surviving spouse (formerly known as the qualifying widow or qualifying widower status) is a filing status that allows you to retain the benefits of the.

For two years after the year of your spouse’s death you can use the qualifying widower status if all of these are true: